Check cashing companies provide vital financial services, especially for individuals who do not have access to traditional banking systems. In this article, we’ll explore common statements about these companies and identify which ones are false. Specifically, we will discuss: “Which of the Following Statements About Check Cashing Companies is False?”

Overview of Check Cashing Companies

Check cashing companies offer a range of financial services, most notably the ability to cash checks without needing a bank account. These companies are typically found in convenient locations like grocery stores, gas stations, and other retail outlets, providing accessible services to those who need immediate access to their funds. Additionally, they often offer extended hours, including 24-hour service in some cases.

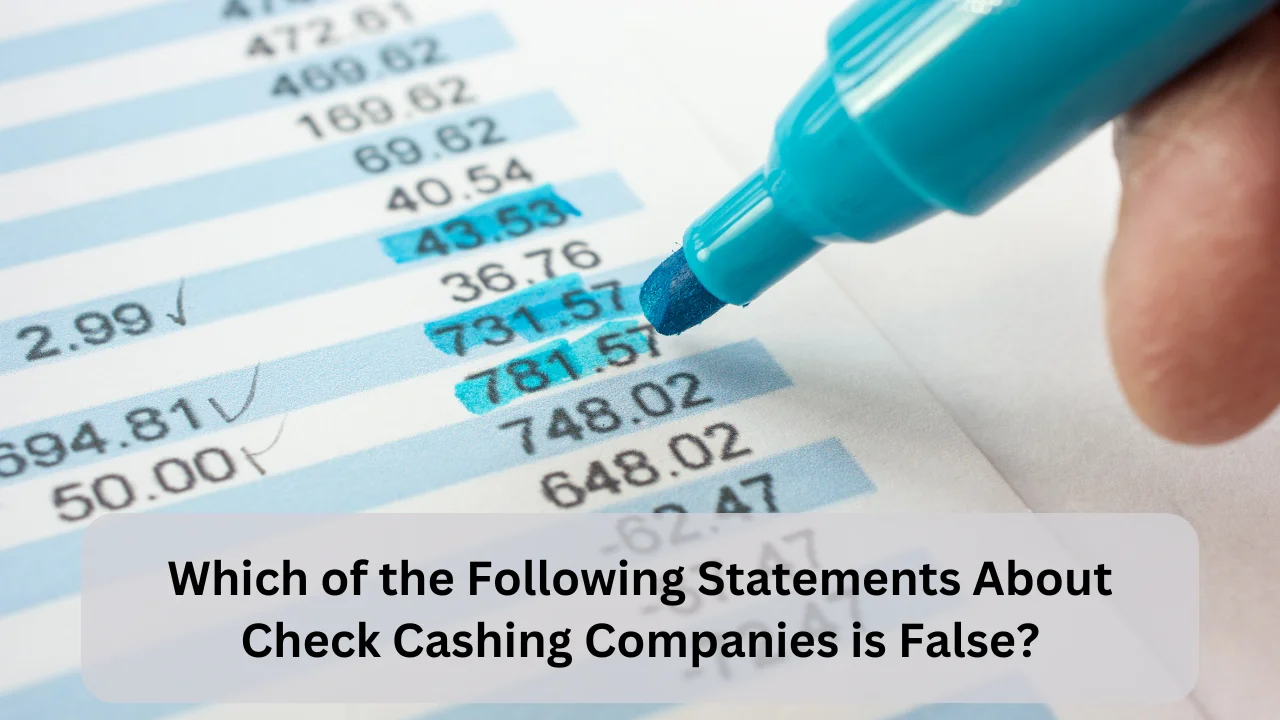

Common Statements About Check Cashing Companies

Check Cashing Companies Charge Low Fees

False: One of the biggest misconceptions about check cashing companies is that they charge low fees. In reality, these companies often charge high fees for their services. The fees can be a percentage of the check amount or a flat fee. For instance, a fee might range from 1% to 12% of the check’s value, which can significantly reduce the amount of money customers take home.

They Are Unregulated

False: Another false statement is that check cashing companies are unregulated. While regulations can vary by state, most check cashing businesses are subject to state and federal regulations to ensure customer protection and secure transactions. These regulations include customer identification requirements and adherence to specific security protocols.

Check Cashing Companies Are Unsafe

False: The notion that check cashing companies are unsafe is also incorrect. Most of these companies follow strict security protocols to ensure the safety of their customers’ funds. They often require customer identification and are bonded and insured to protect against fraud and theft.

They Do Not Offer Other Services

False: It’s a misconception that check cashing companies only cash checks. Many of these businesses provide a variety of other services, including money orders, prepaid cards, bill payment services, and payday loans. These additional services cater to the financial needs of their customers beyond just check cashing.

Only People Without Bank Accounts Use Check Cashing Services

False: While many users of check cashing services do not have bank accounts, this statement is not entirely accurate. People with bank accounts also use these services for the convenience of immediate access to funds, avoiding the waiting period for check clearance in traditional banks.

FAQs

What fees do check cashing companies charge?

Check cashing companies typically charge fees ranging from 1% to 12% of the check’s value or a flat fee.

Are check cashing companies regulated?

Yes, most check cashing companies are regulated by state and federal laws to ensure consumer protection.

Do check cashing companies only cash checks?

No, many check cashing companies offer additional services such as money orders, prepaid cards, bill payments, and payday loans.

Are check cashing companies safe to use?

Yes, most follow strict security protocols and are bonded and insured to protect against fraud and theft.

Can people with bank accounts use check cashing services?

Yes, people with bank accounts also use these services for the convenience of immediate access to funds.

Also Read: Which Is Not a Positive Reason for Using a Credit Card to Finance Purchases?

Conclusion

Check cashing companies play a crucial role in the financial ecosystem by providing essential services to those who might not have access to traditional banking. Throughout this article, we have discussed their importance and the various services they offer. However, it is essential to dispel the myths and false statements about these businesses. Which of the following statements about check cashing companies is false? They charge significant fees, are regulated, maintain safety protocols, offer a range of services, and cater to a diverse customer base. Understanding these facts can help individuals make informed decisions about using check cashing services.

Stephen Norman is a skilled and accomplished writer known for his versatility across numerous niches. He consistently delivers insightful and engaging content in various fields. Stephen’s extensive experience and profound expertise make him a highly sought-after author in the digital writing sphere.